Happy New Year! The good news is that 2024 is a Leap Year giving us an extra 24 hours of an overall 8,784 hours so if you’ve had a sluggish start to 2024, there’s an extra day to catch up! As always, we have a look back at our thoughts on markets this time last year following a disappointing 2022;

‘Difficult periods for equity markets prove difficult times to hold one’s nerve but we believe the old adage of ‘Time and Not Timing’ comes to the fore in periods such as these. How 2023 ultimately plays out for investors is anyone’s guess but we wouldn’t be surprised to see markets surprising to the upside and believe that bond markets now offer good value to investors for the first time in a very long time.’

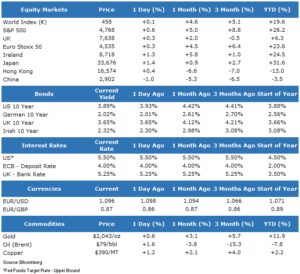

Luckily, both of the foregoing statements turned out to be quite accurate and those investors who remained invested or committed new funds to the market were rewarded in 2023 with a significant rally into the year end. The big investor story for 2023 was the spike in bond yields and the taming of inflation across the globe following a sustained period of interest rate increases – this provided opportunities for investors in government bond markets and cash which hadn’t been there for quite some time. The following is a summary of the major market returns for 2023;

As 2023 drew in to a close, most major indices were in positive territory with the exception of China which may be something to watch out for in 2024. Throughout 2023, the technology-heavy Nasdaq saw the strongest performance returning over 50% in euro terms in a year that also witnessed a doubling of the ECB deposit rate from 2% at the start of the year to 4% by the end of 2023……both may have implications for investors throughout 2024. Whilst volatile, bond yields remained relatively stable throughout the year with a significant rally in US Treasuries as 2023 came to a close on the expectation of interest rate cuts in 2024.

So what does all this mean for investors in 2024 and beyond? As always, we advocate that clients should stick to their long term plan and not have any knee jerk reactions regardless of market direction, be this positive or negative. In saying that, it’s important to be aware of the prevailing investment environment to ensure your portfolio is aligned with both your short and longer term objectives. On reviewing the various investment commentaries for 2024, there are a number of consistent themes, namely, the emergence of Artificial Intelligence (AI) and the corresponding performance of the so called Super-7 (Apple, Microsoft, Amazon, Alphabet, Meta, Nvidia and Tesla) in 2023, the re-emergence of value v’s growth investing in a higher interest rate environment and thirdly, the underperformance of Emerging Markets over the past decade. In relation to the performance of the Super-7, the market capitalisation for this group of US giants is now greater than that of the UK, France, China, and Japan combined. Historically, while such polarisation can often persist over long periods, inevitably at some point, this gap will close. In relation to value v’s growth, the price you pay for a company is the price you pay, value is what you get. There remains plenty of value in global equity markets at the moment, especially for the patient investor. Emerging markets enjoyed a sustained period of growth during the 2000s, led by China, but the more recent decade has been a disappointment with persistent US dollar appreciation, could this be about to change if US interest rates fall in 2024?

Most of these themes are captured in existing client portfolios to one extent or another given our core investment principle of diversification but as always, we recommend at least one annual review throughout the year to discuss your plan and portfolio. The battle against inflation will remain to the fore in 2024 and whilst markets at this stage have priced in a victory, there may remain a few surprises to the downside. We expect the opportunity to capture higher interest rates either via cash or fixed interest securities to wane throughout 2024 and so would urge investors to take advantage of these opportunities whilst they last.