Our Services

Latest from our Blog

Wallstone Relocation from 30th September 2024

| News

Following on from recent correspondence concerning the relocation of our office, we wish to advise that due to unforeseen delays, the date of the relocation has altered and we will remain at our present address until Friday 27th September 2024 next. From Monday 30th September 2024 our new offices will be located at Grant Thornton, […]

Read More Wallstone Acquisition & Relocation

| News

We are delighted to announce that Wallstone Financial Planning has recently been acquired by one of Ireland’s leading consultancy and financial advisory firms, Grant Thornton Financial Counselling. Grant Thornton Financial Counselling (GTFC) comprises a team of highly qualified professionals who offer financial advice to individuals and corporates across a range of areas including […]

Read More Changes to the Pension Landscape

| News

The Finance Act 2022 was enacted on 15 December 2022. Amongst other changes to pensions, the Act confirmed that the Benefit in Kind for an employee, which was previously triggered by an employer contribution to a PRSA, has been removed. This has come into effect on the 1 January 2023. Impact for Employees For […]

Read More ‘Outlook 2024’

| News

Happy New Year! The good news is that 2024 is a Leap Year giving us an extra 24 hours of an overall 8,784 hours so if you’ve had a sluggish start to 2024, there’s an extra day to catch up! As always, we have a look back at our thoughts on markets this time last […]

Read More Irish Commercial Property Update

| News

Significant fall in transactions in the Irish commercial property market for H1 2023 Ireland Investment and Funding Q2 2023 | CBRE Ireland

Read More Wallstone Outlook 2023

| News

As usual, before surmising our ‘Outlook’ for 2023, we look back at some of our thoughts this time last year, one of the more pertinent being; ‘The impact of sustained inflation and the possible corresponding rise in global interest rates cannot be ignored so we suspect 2022 will be a much more challenging year […]

Read More Gerry Moran- President of LIA Ireland 2022

| News

Delighted to see our Managing Director of Wallstone Financial Planning Gerry Moran feature in this month’s January 2022 Irish Broker Magazine as he is elected President of LIA Ireland for 2022. “Honoured and delighted to be elected as President of LIA Ireland for 2022, a brilliant organisation developing and promoting educational standards across the Financial […]

Read More Wallstone Outlook 2022

| News

WALLSTONE ‘OUTLOOK’ 2022 Happy New Year, we hope you had a great Christmas break. A good place to start any ‘Outlook’ is to have a look back at our thoughts for 2021, below are a few excerpts from same; ‘…..the lesson in this is to have your plan, ignore the short-term noise and […]

Read More Why Invest Now?

| News

10th November, 2021 Published in The Sunday Times on October 21st 2021 I’ve a feeling this article may not age well. It’s essentially making the case for investing now. As markets trade near all time-highs, and with stretched valuations it’s a risky limb to go out on. But only if your measuring risk […]

Read More Don’t Neglect The Golden Goose!

| News

Financial planning can be thought of as the art and science of making financial trade-offs under conditions of extreme uncertainty. The biggest uncertainty is not knowing how long we will live for, and how healthy we’ll be while we’re still around. Being a responsible adult with healthy habits can put the odds […]

Read More Inflation- The Real Enemy

| News

The number one enemy of the long-term investor is the financial dragon called inflation (the silent but steady increase of prices over time). Over the last 30 years (about the length of an average two-person retirement), inflation in the UK has resulted in an item costing £1 in 1991 now costing £1.84 in 2021. Your […]

Read More Wallstone Recording- Investment & Property Markets Webinar 28.05.2021

| News

In light of the huge success and attendance at our recent Investment & Property Webinar which took place on Friday 28th May 2021. We would like to thank those of you who tuned in on the day. For those who were unable to attend, we attach a link to a recording of the Webinar […]

Read More Wallstone Webinar 28.05.2021 – Investments & Property Market update

| News

As the world slowly emerges from Covid-19, we thought it may be timely to remind clients how this pandemic has impacted on various asset classes and more importantly, what the future might hold in store for these asset classes. Following a severe market correction in March 2020, global markets have rebounded to all time highs but […]

Read More Wallstone “Outlook”2021

| News

WALLSTONE ‘OUTLOOK’ 2021 A different perspective on the ‘market outlook’ for 2021 from Wallstone…… As I sit here and close off the 2020 diary and open my 2021 version, it’s just struck me that I’m working from the same table at which I dined on Christmas day…………. see snap above! I must say […]

Read More Wallstone Webinar 10th Dec 2020- The Rollercoaster Ride that was 2020

| News

Join us for our Webinar where Paul O’Brien and James Forbes of Goodbody Asset Management will look back at the events of 2020 and how this impacted markets and more importantly, provide us with some insight on how they are positioning their portfolios and some trends to look out for in 2021. The team at Goodbody […]

Read More Limerick Economic Monitor Oct 2020

| News

https://www.limerick.ie/sites/default/files/media/documents/2020-10/limerick-economic-monitor_digital_oct-2020.pdf

Read More Adding Value to your Wealth by engaging a Financial Advisor

| News

Studies in recent years have indicated that Financial Advisors add greater value to their client’s wealth than individuals that don’t engage with a Financial Advisor. It is worth referencing a few studies on this topic. VANGUARD estimated that advisors can add over 3% PER ANNUM in net returns for their clients. Vanguard cited behavioural […]

Read More Is NOW a Good Time To Invest?

| News

In the second of our series of webinars we speak with Paul O’Brien, Head of Investments at Goodbody Asset Managements about the current investment environment and what the future might hold from here. To see our discussion with Paul please click here. Alternatively please feel free to view the slides of our presentation – Is NOW a […]

Read More Office Reopened 29/06/2020

| News

We are delighted to advise that our office has fully re-opened today 29th June 2020 following the Covid-19 restrictions and will operate in adherence to HSE guidelines. This will mean some small changes for face to face meetings to include completion of a short Questionnaire that will need to be returned by email prior to […]

Read More Principles for long-term investment

| News

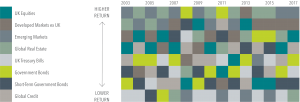

Lessons from history History has shown that the longer you keep your money invested, the greater the chances of a positive outcome. Staying fully invested through a market cycle has, in the past, ensured investors reap greater rewards over the long-term as rebounds after large losses are often significant. If you are concerned about recent […]

Read More Stay Safe, Stay Positive and Stay In Touch

| News

This week rather than our usual market update, we thought we’d try and put some perspective on what’s happening in markets in what truly is an unprecedented time in our history. We are now getting deeper into this pandemic, this is a once in a lifetime public health emergency. From an investment perspective this is called a […]

Read More Working From Home…

| News

Contact arrangements for Wallstone during Covid-19 Crisis Following the restrictions announced by the Irish Government on Friday evening last, our office will continue to remain closed to the public until these restrictions are eased or lifted by the government. However, we recognise that many clients remain concerned about the continuing volatility in global stock markets […]

Read More Don’t Get Comfortable. Stocks Also Bounced in 1929. And 1987, and 2008. A bottom won’t be reached until investors lose all hope.

| News

Are We There Yet? Markets like bouncing, and they certainly bounced Tuesday. The 10-year Treasury yield, at the time of writing, has rebounded to 0.803%, having hit a low early Monday of 0.314%. This is by far the greatest volatility the bond market has experienced since the crisis of 2008-09. U.S. stocks had their best day since 2018, after […]

Read More Tuning Out The Noise – The Corona Virus and Market Declines

| News

The uncertainty surrounding the spread of the coronavirus is unsettling on a human level as well as from the perspective of how markets respond. Amid the anxiety, decades of financial science and long-term investing principles offer guidance. The world is watching with concern the spread of the new coronavirus. The uncertainty is being felt around […]

Read More The Wallstone Quest Team – Lough Derg 2020

| News

Join our Quest Lough Derg 2020 Team! At Wallstone we realise that it’s not just your financial health that is important but that your physical and mental health need to be carefully managed too! With this in mind we are delighted to announce the inaugural Wallstone Quest Team which is sure to test all levels […]

Read More Financial Factsheet 2020

| News

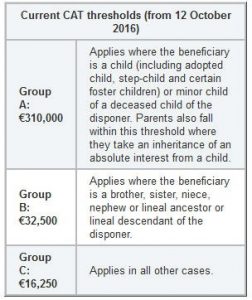

Wallstone Financial Factsheet 2020 A Guide to all you need to know in relation to Irish Taxation in 2020

Read More Ireland Real Estate Market Outlook 2020

| News

The CBRE Outlook 2020 report provides a succinct summary of trends experienced in 2019 and key insights and predictions for each sector of the Irish commercial property market over the course of the next 12 months. In overall terms, the prospects for the Irish commercial property market remain encouraging for the year ahead. Key takeaways […]

Read More The Ladybird Guide to the 2020 Financial Markets Outlook

| News

‘When we talk about investing, we mean years, not days; we mean returns including dividends, not price changes; we mean global, not local; we mean a broad selection of assets, not just stocks. Even in a crisis, we have to remain focused on the long-term prospects, not knee-jerk reactions. Remember too that while politicians like […]

Read More Don’t leave Retirement Planning until it is too late!!

| News

The number of people aged 65 and older will jump from one in eight to one in six by 2030 and the number of people over the age of 85 will double in this period. According to the National Risk Assessment 2019 report launched in August, the number of people eligible for the State pension […]

Read More 5 Mistakes That Directors Of Irish SMEs Are Making On A Regular Basis…

| News

Here at Wallstone Financial Planning we regularly come across risks and opportunities that are being overlooked by prospective clients. We help our clients to identify, address and monitor those opportunities throughout their careers and indeed throughout their retirements. The following is a list of just 5 areas that we often see being over looked by […]

Read More Sweet Dreams – Why you need a good night’s sleep

| News

The percentage of the population who can survive on five hours of sleep or less without any impairment is zero. So, is a good night’s sleep important to you? How much would you be willing to pay to consistently sleep well and awake nourished and content? If there were a high street sleep shop, how […]

Read More Key Questions for Long-Term Investors

| News

Whether you’ve been investing for decades or are just getting started, at some point on your investment journey you’ll likely ask yourself some of the questions below. Trying to answer these questions may be intimidating, but know that you’re not alone. Your financial adviser is here to help. While this is not intended to be an exhaustive […]

Read More CBRE Real Estate Market Outlook 2019

| News

The Outlook 2019 report provides a succinct summary of trends experienced in 2018 and key insights and predictions for each sector of the Irish commercial property market over the course of the next 12 months. In overall terms, the prospects for the Irish commercial property market remain encouraging for the year ahead, despite all the […]

Read More 8 New Year’s Resolutions for Personal Financial Fitness in 2019

| News

Many people go on diets or exercise regimes in January and typically people start with lots of enthusiasm but then they quickly give up. Shaping up your finances is a similar challenge – it is about making this a habit and continuing throughout the year. Getting help is important, whether that is professional financial advice […]

Read More Annual Review Of The World Economy in 2018

| News

As we approach the end of 2018, it is time to take stock of what has been a difficult year for many investors with increased volatility and lower returns in most instances. The attached infographic from Schroders provides a snapshot of the year that has been along with key events to watch out for in […]

Read More Turbo charge your savings with the power of compound interest

| News

“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.” Albert Einstein Albert Einstein once joked that the most powerful force in the universe is neither mass nor energy. The following info-sheet provides an insight as to why Einstein once referred to ‘compound interest’ as “the […]

Read More The Wallstone Winter 2018 Newsletter

| News

Welcome to the latest edition of the Wallstone Financial Planning newsletter. As a company, we recognise the importance of staying in touch with you, our clients, and we hope that this newsletter will provide you with information on issues and topics of importance to you and your business. In each issue you will find information […]

Read More Transferring your UK pension to Ireland

| News

If you have worked in the UK and are concerned about the future accessibility of your UK pension due to Brexit, there are steps that you can take today to minimise any uncertainty that surrounds your future retirement plans…

Read More Pensions for Company Directors 9 Tax Benefits

| News

Corporation tax relief on employer pension contributions; No PRSI payable on employer pension contributions; No USC payable on employer pension contributions; No BIK on employer’s contribution to employee’s pension plan; Tax Free Investment growth; there is no Income Tax, Capital Gains Tax or DIRT tax payable in respect of investment returns; Tax free retirement lump […]

Read More It was just like any other day…..Wednesday, 20th October 2010

| News

It was around 11am and I had just finished a financial review meeting with a client. I was having a coffee at my desk, when I got a pain across my chest and up my right arm. I thought it was possibly severe heartburn and the pain would soon pass. Unfortunately, an hour later I […]

Read More What is an Enduring Power of Attorney and why it is an essential part of future proofing your financial wellbeing…

| News

Legal jargon around the key differences between an Enduring Power of Attorney (“EPOA”) and a general Power of Attorney (“POA”) and more importantly, why you need to have one, can leave you feeling a bit confused… But fear not! Below are the pertinent questions that you need to ask yourself before getting in to […]

Read More Don’t let high costs ruin your retirement!

| News

In the below article, Diarmuid Corcoran looks at the impact that fees can have on a portfolio over time. Here at Wallstone we are passionate about putting our clients first. With this in mind, we have established four key pillars to achieve financial success for our clients, namely Diversification Is Key, Investment Risk and Return […]

Read More Wallstone Race Night 2017

| News

Thursday 27th July witnessed the re-occurrence of the Wallstone client race night at the Greenmount Racecourse, Patrickswell, Limerick. A relaxed and enjoyable evening was had by all with private dining in the Wallstone suite complemented by spot prizes and words of wisdom from the local resident tipster……..!

Read More MDRT Business Conference, Orlando 2017

| News

In June 2017, one of our directors Gerry Moran attended a business conference held annually for financial professionals from around the globe in Orlando, Florida. In the attached presentation, Gerry sets out some of the key messages delivered at the conference relevant to all types of business owners looking to improve their overall customer experience […]

Read More 10 Timeless Rules of Investing

| News

Market Watch– 10 Timeless Rules of Investing Whether you are a veteran of financial markets or new to investing, there are some fundamental rules that can help you achieve your long-term financial goals. The following document produced by Davy Select sets out some important tried and tested rules can help you improve your overall chance […]

Read More Our Team

Gerry Moran

Gerry has been working as a Financial Services professional for over 18 years in various roles advising clients in all areas of wealth accumulation and wealth management. Gerry graduated from the University of Limerick with a BA Hons Degree in 1997, is a Qualified Financial Adviser (QFA) and also holds the internationally recognised designation of Certified Financial Planner. Contact Gerry at Gerry@Wallstone.ie or on 061-440044.

Ruairí McMahon

Ruairí has over 27 years experience in the financial services industry. He has worked with a number of Ireland's leading life assurance companies, investment & private banking firms. Ruairí graduated from the University of Limerick with BA European Studies in 1991, is a Qualified Financial Advisor (“QFA”) and holds the internationally recognised designation of Certified Financial Planner. Contact Ruairí at Ruairí@Wallstone.ie or on 061-440044.

Testimonials

Videos

Send Us a Message

Wallstone

Tel. +353 61 312744

email. financial@wallstone.ie

Mantra Consultants Ltd. t/a Wallstone Financial Planning is regulated by the Central Bank of Ireland

At the end of the term the policy simply lapses. Your premiums have produced no monetary return, but they have provided peace of mind both for you and your dependents. There are two main types:

At the end of the term the policy simply lapses. Your premiums have produced no monetary return, but they have provided peace of mind both for you and your dependents. There are two main types:

Financial Planning Standards Board Ireland Limited (“FPSB Ireland”) administers the CERTIFIED FINANCIAL PLANNER™ certification programme.

Financial Planning Standards Board Ireland Limited (“FPSB Ireland”) administers the CERTIFIED FINANCIAL PLANNER™ certification programme.