‘When we talk about investing, we mean years, not days; we mean returns including dividends, not price changes; we mean global, not local; we mean a broad selection of assets, not just stocks. Even in a crisis, we have to remain focused on the long-term prospects, not knee-jerk reactions. Remember too that while politicians like to portray themselves as stewards of the economy, they could more accurately be described as hostages. However grave the headlines, it’s hard to think of a world in which owning a share of future company profits wouldn’t still be expected to beat the interest on a deposit. Tune out the noise.’…….. Barclays 2020 Outlook.

Notwithstanding the foregoing, here is the ‘Ladybird Guide’ to the 2020 Financial Markets Outlook (as written by fund manager Pramit Ghose) which ties in with our views here at Wallstone;

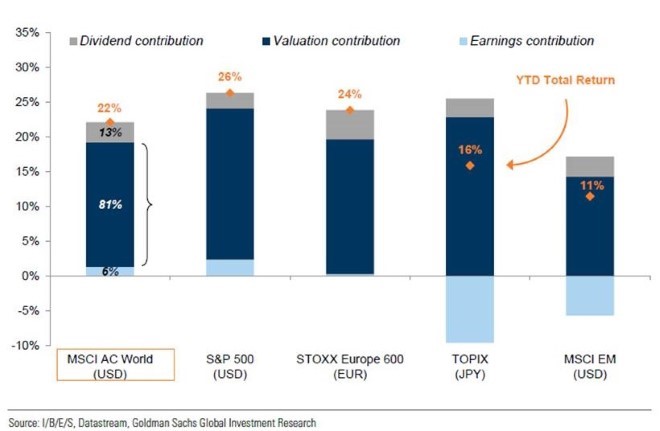

The Ladybird Guide to the 2020 Financial Markets OutlookThe ‘Ladybird Guide’ outlook for 2020 is simple: Low interest rates and low inflation are likely to persist, so the 2020 recession that was feared in mid-2019 should be avoided and economic surprises may actually be on the upside, particularly if the US/China trade deal is benign and happens early in 2020, sparking deferred capital expenditure projects to be re-started and better industrial confidence. Central banks are likely to remain as supportive as possible, although their firepower is significantly diminished after 2019’s rate cuts. Meanwhile, company earnings should grow modestly in 2020, while investor sentiment surveys suggest investors have become more sanguine about 2020’s prospects and have been moving into more cyclical/pro-growth sectors. (Aside: interestingly the Swedish central bank raised rates on 19th December by 0.25%, bringing their base rate to zero, despite a slowdown in the economy and global uncertainties – they are worried that negative rates are damaging the economy by way of artificially-boosted asset prices and debt and increasing the risk of a financial crisis). On the negative side, the strong equity markets of 2019 mean that valuations have become a bit stretched, tempering upside gains. You can clearly see this from the graph below – concentrate on the first bar chart, that of the global index; the dark blue part shows that 81% of the market gain in 2019 was due to valuations becoming more expensive, less than 20% of last year’s gain was due to dividends paid and earnings growth combined. |

|

Warning: Past performance is not a reliable indicator of future performance.

Looking at two bellwether companies Apple and Microsoft, they were truly excellent companies a year ago and they remain truly excellent companies going forward. But Apple shares rose 80%+ in 2019 while Microsoft’s were up some 55%. Looking at valuations, Apple had zero earnings growth in 2019 as iPhone sales growth levelled off but is now some 80% more expensive than a year ago, while Microsoft, even with 20%+ earnings growth, is now some 35% more expensive than a year ago. Even with 10% p.a. earnings growth forecasted for the next few years, both shares are now at pretty high valuation levels and heavily owned by investors (both are in our Compounders portfolio) – there’s a lot of future growth priced into these two shares and it’s hard to see them powering the global stockmarkets in 2020 as they did last year.

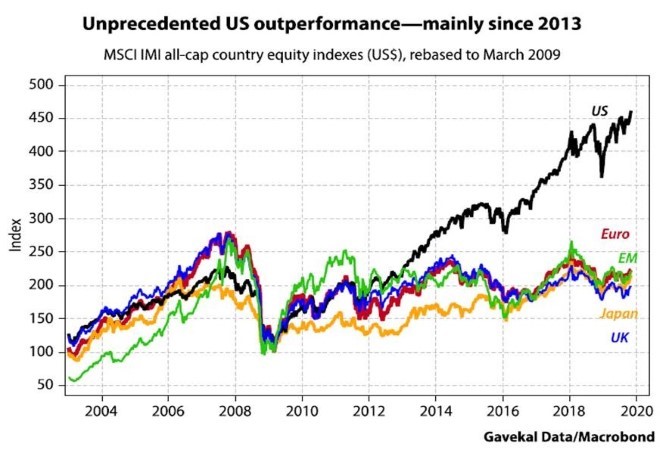

And that leads neatly into our next point – the domination of US equities over the past seven years……………..

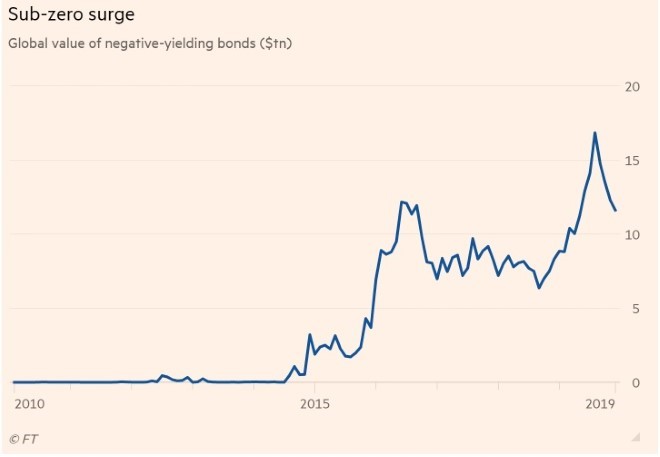

| …it’s pretty staggering when put in a graph. Much of this out-performance is due to better earnings growth in the US, particularly in the Technology sector, but again, as per my comments above on Apple and Microsoft, it’s hard to see the US market being the driving force of global stock markets going forward into 2020 as it has been in recent years. If a benign US/China trade deal can be agreed soon, we think Emerging Markets, a lagging region, can perform well (we have already, for our multi-asset clients, purchased EM Debt index exposure with an attractive c.5% yield), and we are looking at how best to gain exposure to EM in our equity portfolios. The other driver for equity markets, in our view, should be better investor flows into equity funds. Last year saw huge selling of equity funds. With a more benign outlook, investors should be encouraged to return to equities and switch some of the negative yielding bonds into equities. Some $12 trillion of bonds still have negative yields (Noun: Financial-market terminology to describe the situation in which bonds are so expensive that buyers are guaranteed to make a loss.)

So the ‘Ladybird Guide’ outlook for 2020 is simple: No recession + continued easy monetary policy + possible upside from an early US/China trade deal + equity fund inflows IMPLIES positive market background BUT valuation levels constrain upside gains HENCE reasonably good probability of low/mid single digit returns. This is a nice way to ease yourself into 2020’s financial markets. But it can’t be that simple, and as many of you know, we don’t like consensus views. A similar sanguine outlook was the consensus for 2011 – at that time we had had 18 months of rebuilding the global financial system post the Great Financial Crisis, America was starting to recover, interest rates were still falling, so strategists felt reasonably certain of a positive although low return. This consensus view was wrong – crises in the Irish and Greek financial systems led to an existential crisis for the Euro while US debt was downgraded in August as its budget deficit ballooned and Congress disagreed over raising the US’s debt ceiling, and equities fell (modestly) some 3% for the year (but masking a c.15% fall between March and October). It’s hard to believe today that in mid 2011 you could have bought the 10-year German bond with a 3.5% yield (-0.25% today) and the then-crisis-ridden Irish 10-year bond with a 14% yield (now essentially a zero yield). So we predict a modest return from equities for 2020, somewhere around 3% to 6%, but with a -12% to +12% volatility range, keeping vigilant and ready to become much more conservative if some unexpected unpleasant surprise emerges. Obviously it’s hard to predict what this unpleasant surprise might be, perhaps a breakdown of US/China trade talks, a significant escalation of Middle East tensions, a ‘hard Brexit’ in actuality but not name as UK prime minister Johnson pushed for a less amicable divorce from Europe, signs of a 2021 US recession, or simply that investors balk at the high valuations for many excellent but expensive companies (as discussed above). |